SEB internet bank for private customers

An internet bank built around your financial needs

During the time I worked as a CX lead for the SEB internet bank for private customers I did a lot of different projects. Most importantly is that I was a part of a step by step transformation where the deliveries was both user need driven, technical modernization as well as regulation based (such as making the channel accessibility compliant).

Channel Strategy & Digital Experience Vision - 2022

I led a strategic collaboration with SEB’s Channel Management team to define the long-term vision, ambition, and purpose of the digital channel.

The goal

The goal was to create a more coherent, accessible, and user-centric experience in the web channel.

The approach

Through a combination of market analysis, user research, competitor benchmarking, and internal insights, I built a shared understanding of where the digital channels were today and identified the most prioritized target groups for us going forward. This laid the foundation for a clear channel strategy, setting the direction for how we create consistent, impactful experiences for our customers.

The work included defining design principles, aligning with brand and visual direction, building on the design systemm and creating an accessibility vision to ensure we design for all, not most.

A future vision for the web channel was established, with personalization as a core concept, alongside clarified patterns for navigation, user settings, and reusable page guidelines. Finally, I created a strategic roadmap connecting long-term goals to short term actions, enabling cross-team alignment in the organization.

The impact

Brought teams together around a shared vision, making decisions faster and more aligned.

A foundation for design decisions that lead to a more unified experience in the channel.

Introduced a user-focused, accessible channel strategy now guiding both web teams and business stakeholders in their daily work.

Helped prioritize initiatives and focus on the right target groups.

I then led the CX work during a full migration from SEB’s legacy monolith platform to a modern, secure, and scalable technical foundation. At the same time, we launched a refreshed visual design built on an updated design system, ensuring the experience felt easy to use, yet modernized.

My focus was on keeping the user experience strong throughout the transition, while improving navigation, visual consistency, and overall usability. This involved close collaboration with developers, product owners, and architects to navigate technical constraints, maintain design quality, and lay the foundation for a future-proof digital experience.

Migrating to a completely new technical platform - 2022

The high level process and approach:

Conducted qualitative user research and behavioral analysis to identify pain points and opportunities.

Partnered with architects and developers to understand technical constraints and possibilities.

Framed hypotheses and prioritized high-impact initiatives, including a new start page and navigation structure.

Tested solutions through card sortings, surveys, and user interviews.

Delivered updated designs for core elements—start page, navigation, profile menus, footers, support pages, and more.

Refined channel guidelines, design components, and the design system, iterating based on user feedback and performance insights.

Coached 100+ designers across the bank, ensuring adoption of guidelines and consistent experience quality at scale.

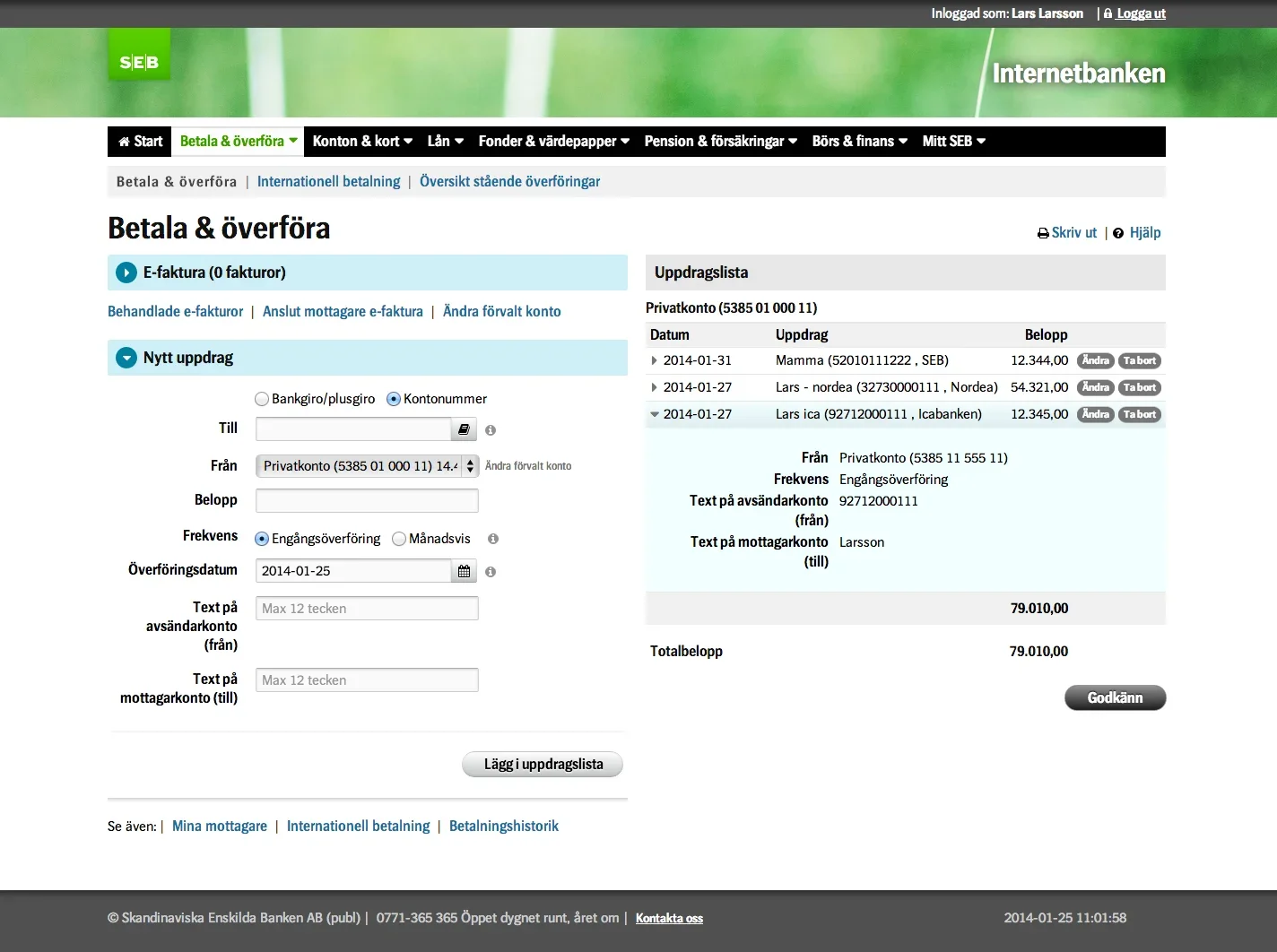

The existing internet bank before release

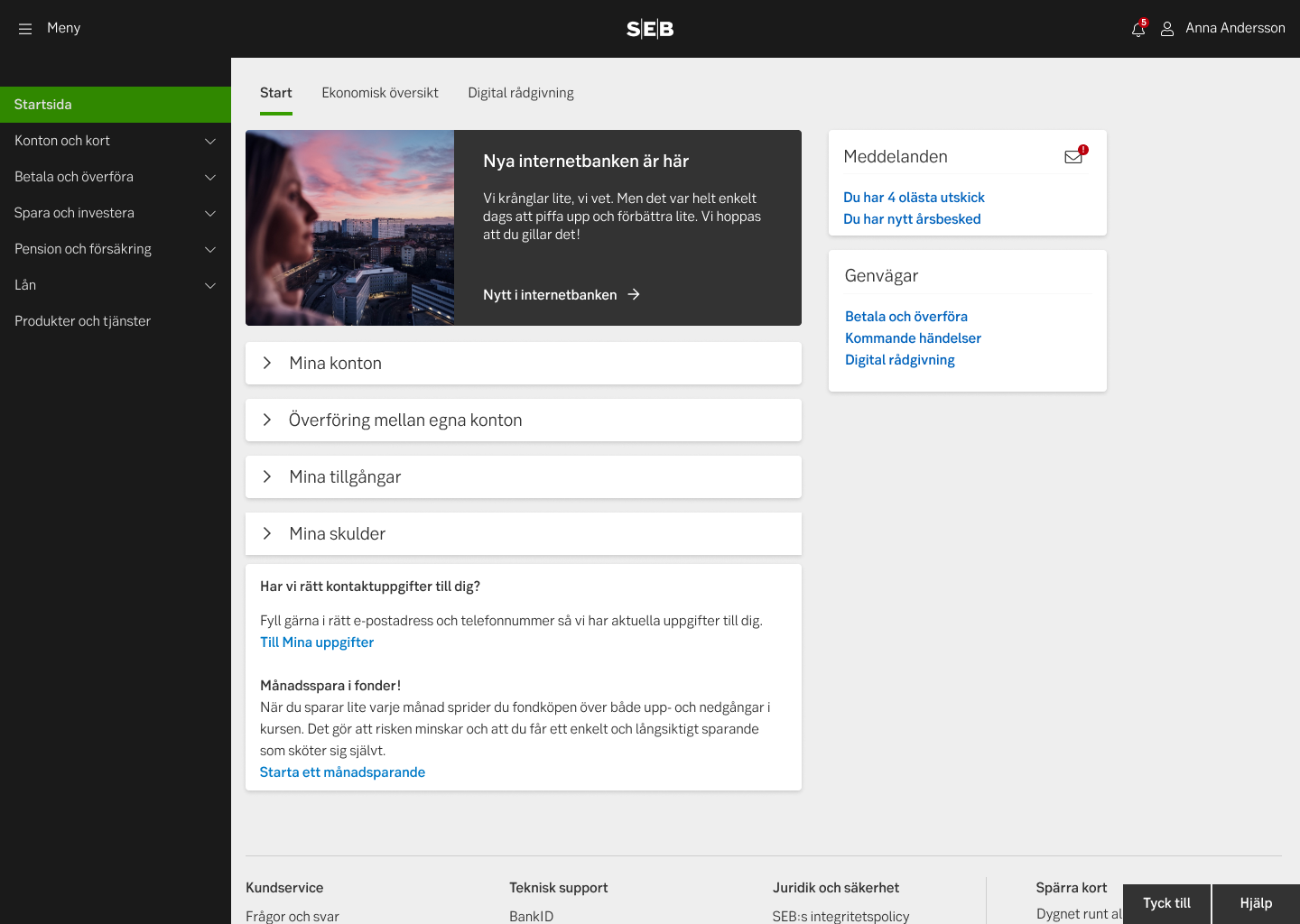

The first release of the new internet bank with new technical platform and design system

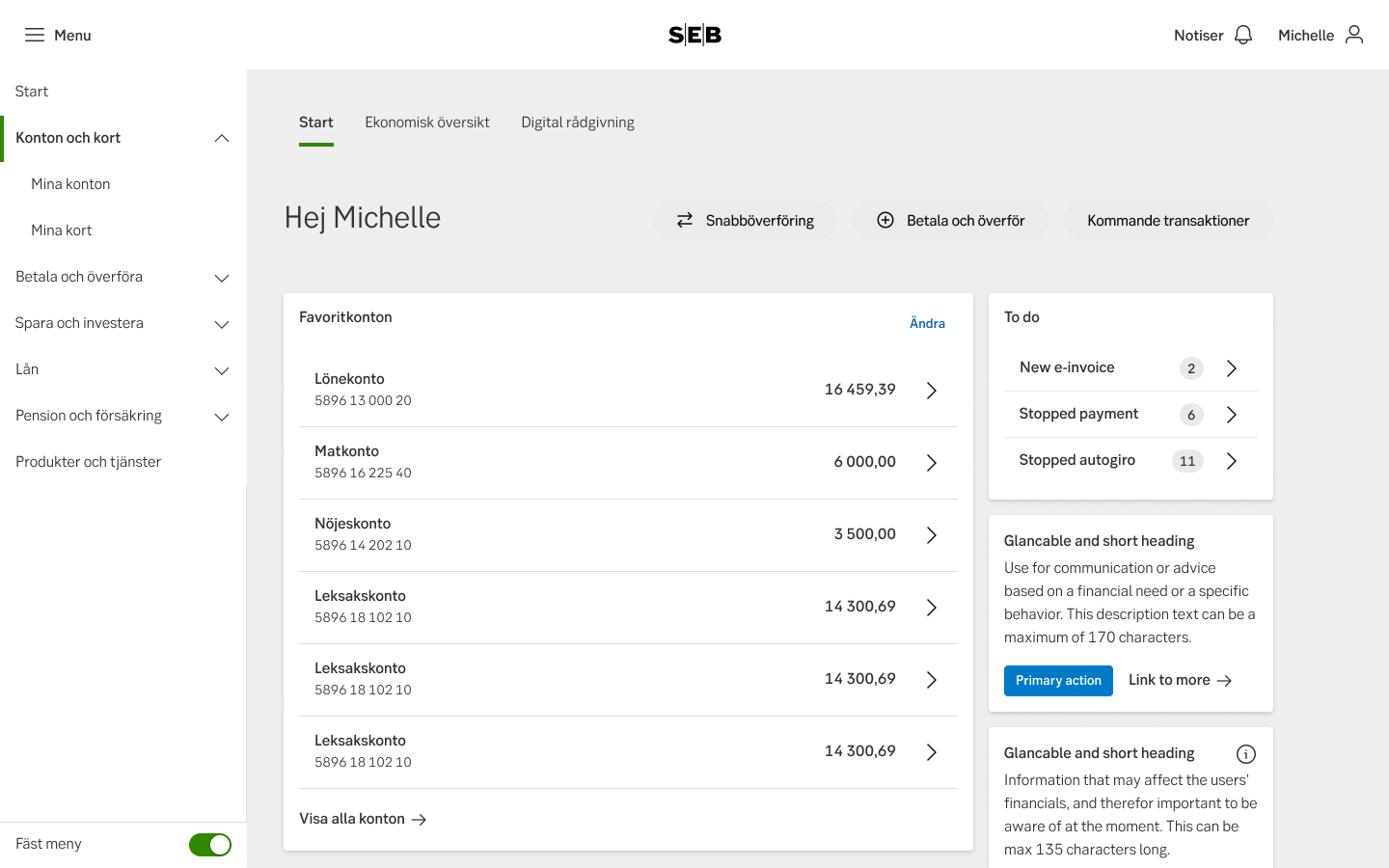

Iteration after release based on user feedback and performance insights.

Outcome of the deliveries

Increased channel NPS (confidential numbers)

Increases use of self service support, decreasing calls to customer service with approx 30%

Increased Digital sales (confidential number)

Future-proof technical platform

Faster time to market

Reduce of IT risk

Reduced development costs

More coherent design, updated design system and visual design aligned with the overall brand.

“Snyggt, enhetligt och rent. Äntligen kan man få en överblick mycket enklare. Plus Apple Pay äntligen! Det känns att ni nu bryr om både kunder och teknik. Bra jobbat!””

“Jag tycker den nya designen är helt fantastisk. Enkelt att hitta och genomföra olika typer av verksamhet”

A new personalized start page - 2023

Part of the bigger transformation to the new technical landscape and update of the channels overall design I lead the work of delivering a new personal start page to the customers.